Contents:

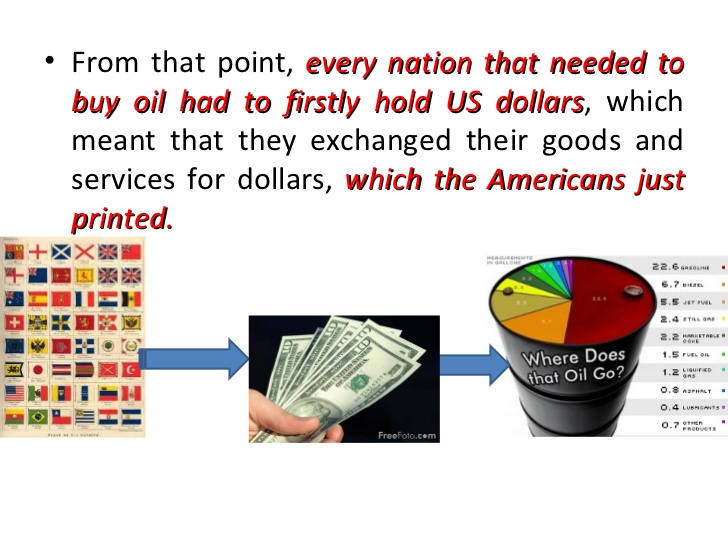

This is the phase where smart money traders and big institutional players try to accumulate or acquire positions without moving the prices too much to the upside. An uptrend in prices with a downtrend in the Accumulation Distribution Line suggests underlying selling pressure that could foreshadow a bearish reversal on the price chart. Rising line with rising volume shows strong buying pressure. Falling line with falling volume shows strong selling pressure. Accumulation Distribution Line is a volume-based indicator, developed by Marc Chaikin which is designed to measure the cumulative flow of money into and out of a security.

The Accumulation Swing Index was developed by Welles Wilder. The head and shoulders bottom is sometimes referred to as an inverse head and shoulders. Example of historic inventory value data with the everyday presentation of a MACD indicator . The blue line is the MACD series correct, the difference between the 12-day and 26-day EMAs of the worth. The red line is the typical or sign sequence, a 9-day EMA of the MACD series.

Volume Weighted Average Price

Update your e-mail and phone number with your stock broker/depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge. Secondary Test is a reflection that market prices have found the top. It is common to have Multiple Secondary Tests, as the market will retest the Preliminary Resistance to check the strength of Sellers. After an Automatic Selloff, Intense buying activity from the public decreases and bullish sentiment becomes weaker.

It is among the oldest and hottest indicators and is often plotted in coloured columns, inexperienced for up volume and pink for down volume, with a moving common. High volume factors to a high interest in an instrument at its current worth and vice versa. Chaikin Oscillator is a technical evaluation software used to measure accumulation-distribution of transferring average convergence-divergence . The technical Analysis Indicator AD is a volume based indicator designed to measure the cumulative flow of money into and out of a security. It’s a sideways/Range bound market activity that happens after an extended Uptrend. This is the phase where smart money traders and big institutional players try to distribute or sell off their positions without moving the prices too much to the downside.

Filecoin’s consolidation persists- Here are the key levels to look out for – AMBCrypto News

Filecoin’s consolidation persists- Here are the key levels to look out for.

Posted: Tue, 04 Apr 2023 07:00:00 GMT [source]

It was then referred to as the Cumulative Money Flow Line. These points are then plotted to create an upward line denoting accumulation and downward moving line denoting distribution. The Accumulation Distribution Line is a cumulative measure of each period’s volume flow, or money flow. I am using accumulation distribution line on a 15 min chart. Do you know that Accumulation and Distribution Line Indicator helps us identify divergences between the volume flow and stock prices?

Calculating the Accumulation Distribution Line

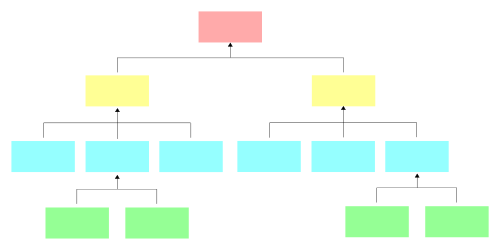

Big Institutional Players and Smart Money traders commonly referred as Composite Man by Wyckoff, take significantly large positions in these types of Ranges. An accumulation/distribution indicator that works better against gaps and with trend coloring. Accumulation/Distribution was developed by Marc Chaikin to provide insight into strength of a trend by measuring flow of buy and sell volume . The fact that A/D only factors current period’s range for calculating the volume multiplier causes problem with price gaps…. There are brief-period cycles that are unrelated to the bullish or bearish market trends.

Bitcoin Holders Aggressively Accumulate, Good News For Rally – Bitcoinist

Bitcoin Holders Aggressively Accumulate, Good News For Rally.

Posted: Mon, 03 Apr 2023 13:36:05 GMT [source]

You can then see what amount of the asset you have accumulated to date. If you try all the days of the month and see when you can sell the most… Accumulation/Distribution explains when the big players buy or sell, according to Wyckoff.

The mostly used values are 12, 26, and 9 days, that’s, MACD. A) A downtrend that checks while the volume remains high is a sign of accumulation taking place and buyers are in control of the market. This means the stock is entering the sell zone from the buy zone and is no longer bullish. A bullish reversal happens when the CMF line moves from the bottom to above the zero line. Apart from incoming trends, CMF can also tell you when a trend reversal is about to happen.

Thinking of Trading Options? Here Are three Things You Should Know

Price Data sourced from NSE feed, price updates are near real-time, unless indicated. Financial data sourced from CMOTS Internet Technologies Pvt. Technical/Fundamental Analysis Charts & Tools provided for research purpose. Please be aware of the risk’s involved in trading & seek independent advice, if necessary. Though TopStockResearch uses 21 days period, Usage of 20 days period is also common among tech Analyst.

During a trading range, falling Accumulation Distribution indicates distribution may be taking place and hence chances of downward breakout. Actually, this indicator is a variant of the more widely used indicator On Balance Volume. They are both used to confirm price changes by way of calculating the respective volume of sales. His other significant contribution to technical analysis was Accumulation Distribution Line . The Accumulation/Distribution indicator is calculated as the value of the closing position [1;-1] multiplied by the current volume of trades. Trading in “Options” based on recommendations from unauthorised / unregistered investmentadvisors and influencers.

What is the Chaikin Money Flow Indicator?

The moving common is a line on the stock chart that connects the typical closing charges over a particular period. This indicator will assist you to comprehend the underlying motion of the worth, as prices don’t move solely in one path. Double Tops/Bottoms – This is a chart analysis indicator that forecasts the changing of trends. It is really easy to observe and understand the chart patterns. The ‘double top’ means when stock on two different instances tests a specific level of cost, and in both the instances the stock hits resistance.

A very quick observation shows us that the closing of the candle is of extreme importance. To oversimplify it, a red bar is shown as a drop on the AD line and a green bar is shown as a rise on the AD line. The cumulative total is plotted and we can see visually if there was an overall accumulation or a distribution pattern in the stock. Trend Analyser is a professional charting and analysis software that comes with state-of-the-art tools to determine trend, momentum, buy and sell points for stocks. I wanted to invest a certain fiat amount each month and was wondering which day would be best to do this. On the last day of the date range, it will close all positions.

The formula calculates the A/D value for a given period by considering the relationship between the closing price, the high and low prices, and the trading volume. A positive A/D value indicates accumulation , while a negative A/D value indicates distribution . The A/D line is a running total of the A/D values over time.

Basic modification of my SFP Momentum Indicator showing accumulation/distribution patterns based on breakouts above previous anchor points. Candles are colored based on whether accumulation or distribution was last. Medic trades using “Smart Money Concepts”, and Medic’s system revolves around the one taught by MentFX (i.e. Structure, Supply/ Demand Zone , and Confirmation). While this system per se doesn’t require the use of a volume indicator, Medic has come to respect the OBV and Accumulation / Distribution . The OBV Ribbon is available in many a shape and form, but Medic…

The vix betting on tomorrow/distribution line gauges supply and demand by looking at where the price closed within the period’s range, and then multiplying that by volume. The A/D indicator is cumulative, meaning one period’s value is added or subtracted from the last. These instruments assist in planning an efficient buying and selling strategy, whereas minimizing risks. Traders usually hear about daily shifting averages , which is the most typical and extensively used indicator.

Selling Climax is another pattern in Accumulation phase characterized by sharp selloff. It indicates that selling pressure has reached a stage in which panic selling by the public will be absorbed by Big Institutional players or Smart money traders. Investors are requested to note that Stock broker is permitted to receive/pay money from/to investor through designated bank accounts only named as client bank accounts. Stock broker is also required to disclose these client bank accounts to Stock Exchange. Hence, you are requested to use following client bank accounts only for the purpose of dealings in your trading account with us. The details of these client bank accounts are also displayed by Stock Exchanges on their website under “Know/ Locate your Stock Broker”.

For example, chartists might use a momentum oscillator to establish oversold levels when 25-week Aroon indicates that the lengthy-term trend is up. Exponential moving averages highlight latest changes in a stock’s worth. By comparing EMAs of different lengths, the MACD collection gauges changes in the development of a inventory.

Best for Options trading training – Intraday trading training in Hyderabad

The A/D line is a running total of the A/D values and can be used to identify trends in buying and selling pressure over time. An uptrend indicates that buying pressure is present consistently, whereas a downtrend indicates that selling pressure is present. Bullish and bearish divergences alert for a potential reversal on the price chart. The Accumulation Distribution Line, like all indicators, should be used with other aspects of technical analysis, such as oscillators and chart patterns. CMF is an indicator that tries to measure buying pressure versus selling pressure. Unlike OBV, it is much simpler to interpret as its value oscillates in positive or negative territory.

- Aroon-Down hit a hundred as prices broke triangle support to signal a continuation lower.

- MACD – The most used analysis indicator on MO Trader App is the Moving-Average Convergence/Divergence .

- High volume factors to a high interest in an instrument at its current worth and vice versa.

- If there’s a movement from above to below the zero line, then the event is termed as a bearish cross.

It appears when the https://1investing.in/ or the security reaches its peak first to make ‘shoulder’ only to fall. It rises again to outperform the previous peak making the current peak its ‘head’. To make trading easy online, there have been various modes created specifically for that purpose.

NSE The National Stock Exchange is one of the largest and most advanced stock exchanges in the world. In other phrases, the momentum oscillator helps to grasp when the market sentiments are undergoing modifications. If you’d prefer to find out about more indicators, Investopedia’s Technical Analysis Course provides a comprehensive introduction to the subject. ASC Teaching style makes the students easier to understand the concepts. His classes are interactive, crystal clear of subject perspective with his own style.

Leave A Comment